NFL Players Gone Bankrupt

Steve Young, the NFL needs you back.

Not so much on the Gridiron per se, though your legacy as a quarterback with the San Francisco 49ers will long be revered in the annals of football history, but as the voice of financial reason for dozens of players who can’t seem to manage their millions.

Indeed, Young, who earned his law degree between seasons during the 1990s and now serves as managing partner of a Utah-based venture-capital firm, is a rare example of post-career success.

Despite their median $900,000 annual salaries, a surprising number of NFL players (some estimate up to 80 percent) squander their fortunes in the years immediately following their retirement.

In 2010 alone, former Pittsburgh Steeler lineman Dermontti Dawson joined New York Jets backup QB Mark Brunell, who is still on the field, in bankruptcy court.

But they are hardly alone. The NFL is replete with tales of financial fumbles.

In most cases, the players made bad investment choices, spent frivolously, fell victim to predatory advisors or assigned their less-than-qualified friends or family to handle their affairs.

Some also blame their risk-taking DNA, which is an asset on the field, but a liability when it comes to managing money.

But Susan Bradley, a certified financial planner and founder of the Sudden Money Institute, who works with the NFL to develop life training skills, says it’s a fate that would befall most anyone forced to manage overnight wealth.

“Do they have a problem managing money in their professional career? Sure, you would too,” she says, noting players have a narrow window of opportunity (usually just a few years) to earn enough to last a lifetime.

They also face significant pressure to lead a luxury lifestyle and have virtually no free time to focus on finances with the rigorous demands of professional sports.

Too true. But it’s a challenge most of us would love to tackle.

The following ten NFL players—who lost it all at one point—unfortunately got sacked.

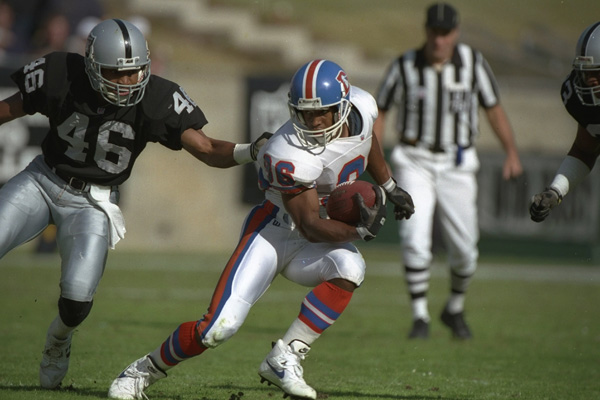

Marlin Briscoe

His trailblazing career and subsequent fall from grace is nothing short of legend in pro football history – not to mention the subject of a feature film due out early next year.

Drafted by the Denver Broncos in 1968, Marlin “The Magician” Briscoe broke the color barrier halfway through his rookie season, becoming the first African-American starting quarterback in NFL history.

He later played for the Miami Dolphins, San Diego Chargers, Detroit Lions and New England Patriots before retiring in 1976 to work as a municipal bonds broker in Los Angeles.

His personal life – and personal finances – suffered a painful slide after that. An addiction to crack cocaine left Briscoe homeless and ultimately behind bars. Following his release and recovery, however, the Oakland, Calif.. native turned his life around – starting a football camp for kids and serving as the director of the Boys and Girls Club in Long Beach, Calif. He also mentors current NFL stars.

Raghib 'Rocket' Ismail

You’ve got to hand it to him. The Rocket doesn’t give up. Though he earned an estimated $18 million during his 10-year NFL career, most recently with the Dallas Cowboys, he lost most of it in a series of bad investment picks that began in 1991.

They included a theme restaurant called Rock N’ Roll Café, the production of an inspirational religious movie, the music label COZ Records, a new cosmetic procedure that purportedly helped to oxygenate the skin, a phone-card dispensing company and a retail store called “It’s in the Name” where tourists could purchase framed calligraphy of names or proverb. All went belly up.

Today, Ismail is listed among the investors of Bite Tech, Inc., which designs specialty mouth guards. He never filed for bankruptcy, still appears regularly on ESPN and works as an inspirational speaker, often at churches.

Johnny Unitas

His superstar career with the Baltimore Colts during the 1950s is widely credited with turning televised football into a national pastime - to this day his record of 47 consecutive games with a touchdown pass is considered by most to be unbreakable.

Unfortunately, his prowess with the pigskin did not translate into business savvy. John “Johnny” C. Unitas, who was elected into the Hall of Fame in 1979, made a series of bad business moves both before and after he retired from the field in 1974.

Investments in a bowling alley chain during the 1960s were less than profitable, as were subsequent real estate deals in Florida, a failed prime rib restaurant partnership and a company that made circuit boards, for which creditors were attempting to collect nearly $4 million in personally guaranteed loans from Unitas and his partners. The Hall of Fame QB filed for Chapter 11 bankruptcy in 1991, without disclosing his debts, to protect his personal assets from creditors.

Michael Vick

No financial fumble list would be complete without a mention of NFL bad boy Michael Vick.

After being sentenced in 2007 to 23 months in jail for his involvement in an illegal dogfighting ring, the former Atlanta Falcons quarterback forfeited his record $130 million contract, along with an estimated $7 million a year in endorsement deals from Nike and Coca-Cola and everyone else.

He negotiated for Ch. 11 bankruptcy in 2008, listing debt of $10 million to $50 million. But there’s still time for redemption. After his release from prison, Vick joined the Philadelphia Eagles in 2009 and 2010, earning the prestigious Comeback Player of the Year award. As a free agent this year, many predict another fat NFL contract for the record-breaking quarterback. Now, if he can just get those creditors off his back.

Deuce McAllister

As the New Orleans Saints all-time leading rusher, Dulymus “Deuce” McAllister raked in an estimated $70 million during his NFL career.

Apparently, it wasn’t enough. Debt related to his failed Nissan car dealership in Jackson, Miss., including personal guarantees on loans for which he defaulted, forced the famous running back into Ch. 11 bankruptcy in 2010 – the same year he retired. Nissan has stated publicly that McAllister owed nearly $7 million, including interest, after defaulting on his debt and then exceeding his credit line.

Today, McAllister still owns a luxury car dealership in Jackson, invests in the restoration of the historic King Edward Hotel in Jackson and runs the Catch 22 Foundation, dedicated to enhancing the lives of youth in Mississippi and Louisiana.

Mark Brunell

It was the real estate recession that put the former Jacksonville Jaguars quarterback on the financial injury list. The three-time Pro Bowler, who raked in more than $50 million during his decade-long career and took home a Super Bowl ring in the 2009-2010 season with the New Orleans Saints, filed for Ch. 11 bankruptcy in June 2010.

His filing listed $5.5 million in assets and nearly $25 million in debt after several real estate projects in which he had invested in Florida and Michigan went belly up. His personal guarantees on a number of business loans put the final nail in the coffin.

Today, Brunell plays backup for New York Jets QB Mark Sanchez and continues to operate football camps via his company Mark Brunell Enterprises. Let’s hope those future football greats pay up.

Travis Henry

It was his penchant for producing offspring that cost Travel Henry his fortune – that and a little cocaine trafficking incident. Having fathered 11 children by 10 different mothers (one had twins), the former running back for the Buffalo Bills and Denver Broncos has indicated in various court filings that his child support payments of roughly $180,000 per year have left him penniless.

Henry was cut by the Broncos in 2008, receiving less than $7 million from his 5-year $25 million contract. A year later, he was sentenced to three years in prison on federal drug charges following a cocaine sting.

Dermontti Dawson

The real estate recession hit Dermontti Dawson like, well, a linebacker. The one-time highest paid offensive lineman in Pittsburgh Steelers history, earning $4.2 million per year at the peak of his 13-year career, filed for Ch. 7 bankruptcy last year citing $69 million in debt.

Dawson’s money troubles primarily stem from his personal guaranty on a number of failed real estate ventures including shopping centers and single family home developments. His home and personal belongings, including watches, cars, jewelry and personal memorabilia, were auctioned off late last year, netting a reported $775,000.

Lawrence Taylor

It was a career marked by controversy for former Giants linebacker Lawrence Taylor, starting in 1988 when the NFL suspended him for failing a second drug test. The real trouble began, however, both personal and financial, after his retirement in 1994. He was arrested in two states on drug charges in 1996 and filed for bankruptcy in 1998 to keep creditors from taking his house.

Two years later, he received five years of federal probation for falsifying tax documents and tax evasion. And in 2009 he was arrested for fleeing the scene of an accident, and the statutory rape of a 16-year old girl, for which he is currently serving six years probation as part of a plea agreement.

Arthur Marshall

When Arthur Marshall went down, he went down big. The former Broncos and Giants receiver started serving a five-year prison sentence last August after pleading guilty to two counts of bank fraud.

Charges included providing false personal information on his mortgage applications, real estate contracts and other documents he used to obtain loans for the construction of homes in Augusta, Ga. – part of an elaborate mortgage fraud scheme. The jig was up when his housing project imploded during the real estate recession.

He was also ordered by the courts to pay more than $3.6 million in restitution to his victims, which included several banks, members of the American Legion and a family paid Marshall $100,000 for a home and never received the property title. His 2008 Ch. 11 bankruptcy filing for his business, Custom Contractors, listed some $11 million in debt.

No comments:

Post a Comment